In his book, Islamic Finance,Mufi Taqi Usmaani explains that the

western concept of a legal entity or juridical person (the company)

with its effect of limited liability is permissible in Islam. In

terms of this concept the partners in a business are not responsible

for all the debts they incur. They are committed for only the initial

capital of the company. Their private assets cannot be acquired by

the creditors if the company's assets are insufficient to settle the

debts. Please comment.

Hadhrat Mufti Taqi Saheb has erred in his opinion on this matter.

Islam does not recognize the concept of a fictitious person called

`juridical person'. Islam also holds the debtors liable for their

full debt. They cannot escape their liabilities, responsibilities and

obligations under cover of the kuffaar company-concept. The creditors

will have the right to demand their Huqooq even in Qiyaamah. We have

written a refutation of the view presented by Hadhrat Mufti Taqi

Saheb. Anyone interested in the detailed discussion may write to us

for a copy. Please send a stamp of R3. People from other countries

should not send stamps. Stamps of other countries cannot be used in

South Africa.

################################################## ##

Also in his book, Mufti Taqi legalizes interest on late payment of

instalments. He calls it a `penalty' payment. But this is interest

called by another name. What is the Shariah's ruling on this question?

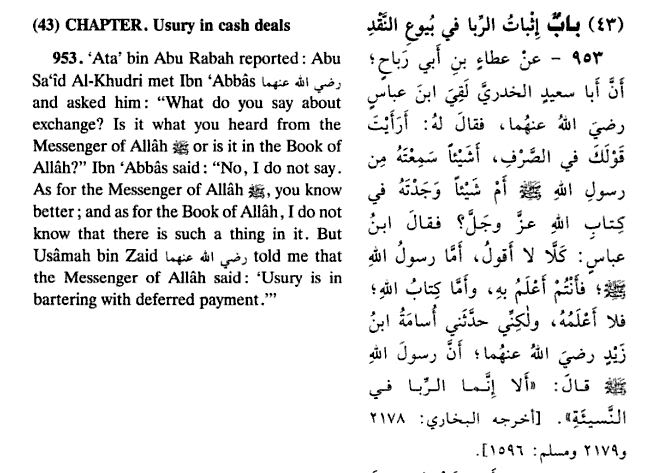

Interest called by any name remains haraam. The `penalty' mentioned

is haraam riba. The arguments which Hadhrat Mufti Taqi Saheb

presented in his book are exceedingly weak, in fact spurious. This

opinion militates against all the Nusoos (categoric Qur'aanic aayaat

and Ahaadith of the Mutawaatir category). There is no scope for this

`penalty'. Insha'Allah, we are in the process of preparing a

refutation in response to the arguments which Hadhrat Mufti Taqi

Saheb has presented in substantiation of the legality of interest on

late payment of instalments.

Note: Read "Penalty of Default" in the books sections of this website

for a detailed discussion.

#############################################

http://www.al-inaam.com/fataawa/shar...res_stocks.htm

Our opinion, based upon the above-mentioned substantiations, is that

purchasing shares is not permissible and receiving proceeds upon them

will be Riba. We urge the public to refrain from investing in such

ventures. There are other permissible income generating alternatives.

Thus, we advise looking into other alternatives as a means of saving

one's income from Haram wealth. May Allah Ta'ala grant us all the

courage to remain steadfast upon all the injunctions of Shariah.

Ameen.

####################

http://www.meezanbank.com/docs/Fatwa...%20Banking.pdf

################################################## #########

"ISLAMIC BANKS AND RIBA"

http://www.themajlis.net/Sections-article85-p1.html

Question

The Al-Baraka Islamic Bank charges a 'penalty' on late payment of

instalments. Is this not like the interest which non-Muslim banks

charge when an instalment is not met on due date? Al-Baraka claims

that Mufti Taqi Usmani of Karachi Darul Uloom, Pakistan has given the

okay for this 'penalty'. Please comment.

Answer

The `penalty' which Al-Baraka allegedly charges on overdue

instalments is haraam riba. Interest cannot be legalized by changing

its name and calling it penalty. Whether interest is described as

penalty, profit, dividend, service fee, etc., it remains haraam riba.

We do not know what question Al-Baraka has posed to Mufti Taqi Saheb

and in which way the question was adorned nor have we seen the

Mufti's fatwa or opinion. But, even if Mufti Taqi Saheb has issued a

`fatwa' of permissibility, it is a grievious blunder and not a fatwa

of the Shariah. It will be his personal opinion which has no validity

in the Shariah.

The modernists who are anti-Taqleed and who have shrugged off the

Taqleed of the Math-habs, are quick to hide behind the skirts of

liberal-minded scholars like Mufti Taqi Saheb who generally presents

his personal opinion on contemporary issues. Mufti Taqi Saheb's

opinions are becoming increasingly contradictory of the Shariah.

Hence, we cannot attach much importance to what he says. In view of

his liberal attitude and quick presentation of opinion we find

modernists like Judge Navsa of the MPL committee and modernists

attached to banks and similar institutions looking up to him for such

"fatwas" which depart from the Shariah and which are widely divergent

from Shar'i views which have been reliably transmitted to us from the

Akaabireen. There is no doubt in the prohibition of the interest

which Al-Baraka charges and which it tries to conceal under

subterfuge of the misnomer, `penalty'.

Question

When buying a vehicle through Al-Baraka Islamic Bank, they insist

that we take out insurance. Is this permissible. We have all along

understood that insurance is haraam. How can an Islamic bank

stipulate that a Muslim client takes out insurance?

Answer

Al-Baraka and similar other Muslim banks are far from Islamic. They

generally operate in the same way as the non-Muslim banks. People are

confused and misled with the many Islamic terms they use to describe

their transactions and deals. The fact that they deal in interest and

impose haraam riba insurance on Muslim clients testify to the

hollowness of their claims. Insurance is haraam. It is haraam for a

Muslim bank to stipulate insurance.

CREDIT BUYING

Question

A vehicle nowadays is a necessity. Even if it is not solely for

business purposes, those who are observant of Purdah find it

extremely difficult to move from place to place without their own

vehicle. Beside that proper purdah cannot be observed when using

public transport, there are too many dangers. There is no need to

explain these. The only way most people can acquire a vehicle is

through the banks. But the banks all deal in interest. Is there any

way in which a bank deal could be made to conform to the Shariah?

Answer

Undoubtedly, all banks, even the so-called `Islamic' banks deal in

riba. But there is a way in which a deal could be made to conform to

the Shariah even if the bank is a non-Muslim one. It is really a

simple issue. The only requirement is that the bank be made to

understand that the contract should be correctly worded. Firstly, the

bank has to purchase the vehicle. This is what the bank in any case

does. The bank being the owner of the vehicle sells it to the client.

The price of the vehicle (not the cash price) should be clearly

stated in the contract. The price will be the sum of the deposit and

all the instalments. This full amount should be recorded so that the

client is fully aware of the purchase price at the time of the

transaction. The client should not obtain insurance. Insurance is

haraam. The bank should take out insurance if it wishes. The bank

should pay for the insurance. It being a non-Muslim institution, it

can do as it pleases. The bank knows the total amount it wants for

the vehicle at the end of the day. The total amount the bank wants

comprises of the cash price, the finance charges (interest), the

insurance and whatever other charges there may be. The buyer of the

vehicle should be concerned with only the end figure which is his

purchase price. This end price must be stated at the time of the

transaction. The buyer simply purchases the vehicle for this final

amount which is paid in a specified number of fixed monthly

instalments.

The bank should work its charges, etc. into the price and present a

final single figure to the buyer. The following example illustrates

this deal:

Cash price of vehicle ... R100,000

Insurance paid by the bank... 30,000

Finance charges, etc. ... 70,000

R200,000

The purchase price is R200,000. This is the amount which the contract/

agreement should state. The buyer knows now that he is buying the

vehicle for R200,000. It does not matter how the bank structures its

calculation to reach this figure. It can do this as it pleases. The

buyer is interested in only the R200,000 which he will pay in 60

equal monthly instalments. In fact, the instalments need not be

equal. Any amounts could be agreed on as long as the instalments are

fixed and known.

There should be no interest (`penalty') charged for any late payment

of instalments. The bank has to take into consideration all these

factors and the "rate of interest" over the 60 months. There should

be no hidden charges which will later surface in the statements. If a

bank agrees to this simple system, buying a vehicle or even a

property in this way will be permissible irrespective of the bank

being a non-Muslim bank or a so-called `Islamic' bank.

If a bank is made to understand the practicality of this simple

method, it will in fact render itself a favour.. There is no need for

the fancy religious sounding terms of muraabahah, mudhaarabah,

mushaarakah, etc., etc. Buying a vehicle or a property on credit is

the same as buying a loaf of bread or any item on credit.

The bank may be required by law to follow certain procedures to

satisfy certain acts such as the Usury Act, etc. That is the non-

Muslim bank's problem. The bank can draw up its usual agreement to

satisfy the law. But as far as the buyer of the vehicle/property is

concerned, there are only two elements in the transaction:

The fixed purchase price which is declared at the time of the

transaction.

The specified number of fixed monthly instalments into which the

purchase price is divided.

There is nothing else. No insurance, no penalty (interest) for late

payment and no hidden charges which would cause the instalments to

fluctuate. Such a deal is valid and permissible in the Shariah.

To secure its interests, the bank can pass an interest-free bond over

the item (the vehicle or property, etc.), or have what they term a

lien.

LEASING

Leasing a vehicle or any equipment from a bank can also be validly

transacted. Leasing in fact may be simpler than purchasing. only the

monthly rental has to be agreed on. The rental will be fixed monthly

payments and the lease term has to be specified. There should be no

ambiguity and no hidden charges. The bank has to work all its charges

into the fixed monthly rental payment. At the end of the lease term,

the bank (the lessor) and the lessee can enter into a sale agreement.

The bank can sell the vehicle/equipment, etc. to the lessee for a

price which will be mutually agreed on. This should pose no problem

as presently the banks sell the leased vehicle to the lessee for a

nominal price at the end of the lease term.

However, in the leasing system, it cannot be stipulated that the bank

is obliged to sell the vehicle to the lessee at the end of the term.

The sale is voluntary.

http://mac.abc.se/~onesr/ez/in/it1/C....Isl.Banks.txt

Hide

Hide Looks like you're enjoying the discussion, but you're not signed up for an account.

Looks like you're enjoying the discussion, but you're not signed up for an account.

Bookmarks